To reach their goals, decision-makers need reliable predictive systems to evaluate beforehand the impact of strategic and tactical moves.

Over the past few years, the proliferation of data skyrocketed due to the rapid technological advancements. As a result, the business landscape has been revolutionizing due to visionary innovators reshaping new forms of competition. While laggards were looking around, some companies went beyond buzzwords and leveraged their capabilities to capture disproportionate benefits, in relation to profit gains, growth and operational efficiency-effectiveness.

Business analytics, IoT, digitization of assets, including infrastructures, connected devices, firm’s processes, and the workforce: all these phenomena disrupted business models affecting people’s daily life. But another huge wave is coming. Advances in robotics, AI, and machine learning will push the frontier of what machines are capable of doing in all facets of a business. In such a fast-paced environment, companies seek to ride the wave with advanced analysis.

What-if analysis: a 360° overview

Nowadays decision-makers need reliable predictive systems to check beforehand the impact of strategic or tactical moves to reach their goals. In this context, what-if analysis is a data-intensive simulation whose aim is to examine the behavior of a complex system, such as the business environment or the critical reasoning of multivariable scenarios. Common is indeed the application of simulations to a wide variety of fields, including engineering, psychology, biology and so forth.

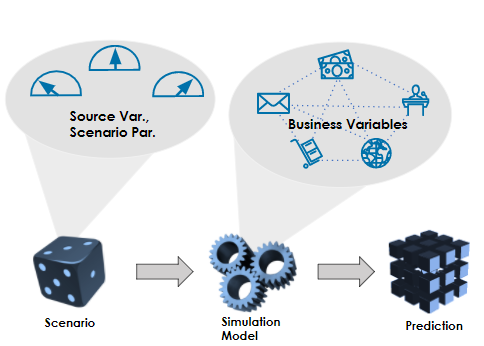

Put more theoretically, according to the leading literature, the what-if is intended to measure how variations in a set of independent variables impact a set of dependent variables referring to a given simulation model, which usually is a simplified version of reality. So formulating scenarios enables the building of a hypothetical world that the analyst or researcher can then query and navigate.

The what-if analysis can support decision makers along the investigation of a set of alternative approaches to forecast or estimate according to the context of the application.

The design of the analysis

Designing a what-if analysis requires a methodological framework able to detect the true levers to pull in the hands of analysts or even end-users. According to the literature, the following list may be considered as the theoretical skeleton for approaching a what-if analysis effectively:

- Goal analysis, aimed at determining which business phenomena are to be simulated, and how they will be characterized. The variables must be identified according to the level of granularity and impact on the goal analyzed;

- Business modeling, which builds a simplified model of the application domain to help the designer and end-users to understand the business phenomenon as well as give her some preliminary indications about which aspects can be either neglected or simplified for simulation;

- Data source analysis, aimed at understanding what and where information can be extracted;

- Multidimensional modeling, which defines the multidimensional schema describing the prediction by taking into account the static part of the business model produced at phase II and respecting the requirements outlined in phase 1;

- Simulation modeling, whose aim is to define, based on the business model, the simulation model allowing the prediction to be practically structured, for each given scenario, from the source data available;

- Data design and implementation, during which the multidimensional schema of the prediction and the simulation model are implemented on the chosen platform, to create a pilot for testing;

- Validation, aimed at evaluating, together with the end-users, how the simulation model fits the real business model and how reliable the prediction is. What-if analysis is not a one-way process, but it has to be iterated seeking for the best possible fit. The higher this fit, the more effectively analysts can actively manage the simulations.

A data-driven approach to the strategy execution

In this environment, the most successful businesses over the next decade will be those able to execute strategy better than their competitors by exploiting data to ensure the right alignment with strategy formulation. The execution is the result of thousands of decisions made every day by employees acting according to the information they capture from data inspecting and modeling.

In this scenario, advanced analytics on a wide range of data could be a source of competitive advantage in the decision making process and measurement activities. A what-if approach in key financial and business processes allows being always prepared to sudden changes driven by independent variables impacting on business performances.

A what-if analysis in corporate finance processes

To build a set of scenarios that reflect different assumptions on future macroeconomic, industry or business developments seem to be the right approach to a “fair” company’s valuation. Empowered with a robust model, senior management can use the sensitivity analysis to understand how changes in key inputs can impact on the value creation theme. In a preliminary phase, two steps should be executed:

- Assessing the impact of individual drivers: start by testing each input one at a time to see which has the largest impact on the company’s valuation;

- Analyzing trade-offs: strategic choices typically involve trade-offs between inputs into a valuation model (i.e. raising prices leads to fewer purchases, lowering inventory results in more missed sales).

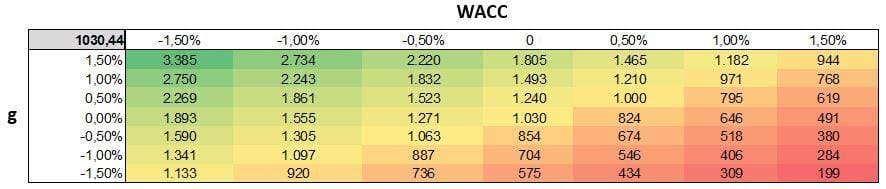

Then, when it comes to analyzing scenarios for the company’s valuation within a DCF model (Discounted cash flow), it is fundamental to review assumptions critically. In the valuation field, this can be stretched along many variables. Here below a graphical representation of the analysis is presented. The marginal variations of the weighted average cost of capital (WACC) and the growth rate impact the EV directly via the formulas of corporate valuation.

As long as the spread between ROIC and WACC is positive, the new growth creates value. In the opposite case, or in the increase of the so-called discount factor the EV moves at the bottom-right side of the matrix.

Limitations and new fields of research

Although an input-by-input sensitivity analysis will increase the knowledge about which inputs drive the valuation, its use is limited. Inputs rarely change in isolation: for instance, an increase in selling expenses is likely to lead to an increase in revenue growth. Moreover, when two inputs are changed simultaneously, interactions can cause the combined effect to differ from the sum of the individual effects. Despite this limitation, wise companies' decision makers should always recall to their minds how a neglected risk is a risk taken in the real state of things.

This article has been written by Antonio Di Guida, Junior Business Analyst, Giovanni Gazzani, Junior Business Analyst, and Salvatore Pelliccia, Junior Consultant at SDG Group Italy.

.png?width=2000&name=SDG%20-%20Logo%20White%20(1).png)