The evolving and changing environment requires companies to adopt more flexible tools.

The budget process has been adopted for the first time as a key performance driver at the beginning of the twentieth-century. Over time, it has become increasingly important as a planning and controlling tool.

However, in recent times, traditional budgeting process has been criticized for not being totally in line with business needs. The evolving and changing environment requires companies to adopt more flexible tools: beyond budgeting represents an alternative approach since it tries to resolve the weaknesses and limitations of traditional approaches to budgeting.

Limits of the traditional budget

- Costly and time-consuming

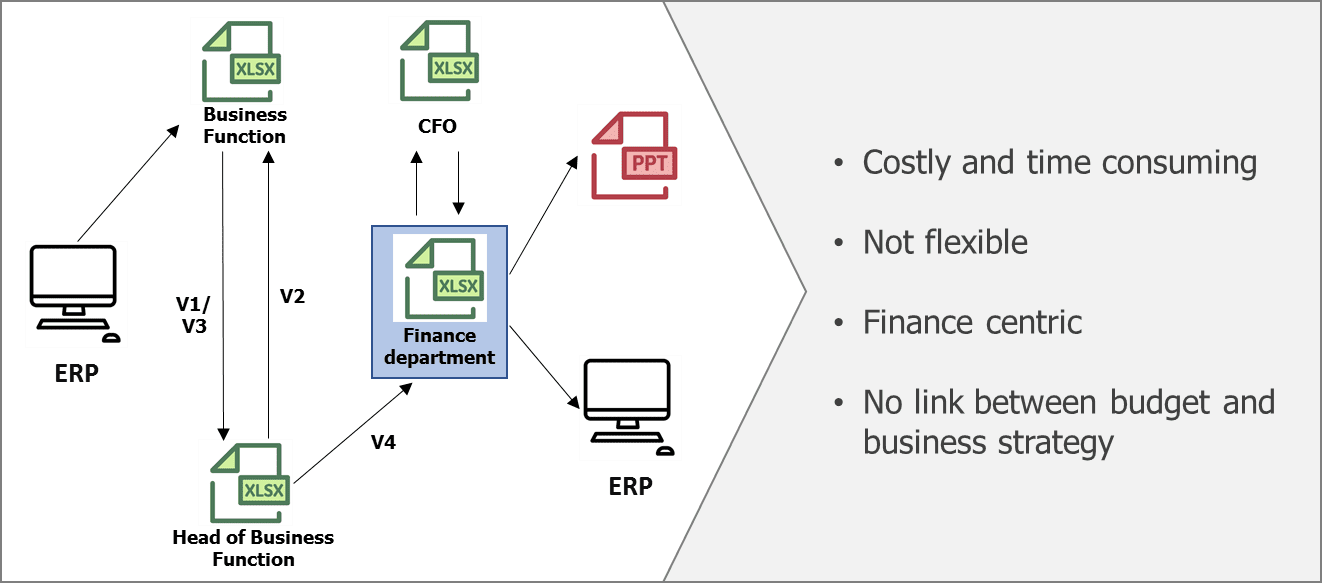

Traditional budgeting process consumes enormous amounts of time and resources within the finance department and individual business units, providing little value in return. One of the reasons traditional budgeting takes up too much time is the use of spreadsheets that contain inherent inefficiencies: high probability of human errors, segregation of duties issues and not accurate formulations.

- Lack of flexibility

Traditional budgeting produces inaccurate and unreliable results. This mainly resulted from spreadsheets being not flexible enough to provide a more dynamic assessment; this means that traditional budgeting tools are not only imprecise but also not able to provide a complete picture of the business needs.

- Traditional budgeting process is too centralized

The complexities of today’s markets require a collaborative approach for the budgeting process among the different companies’ areas. Most of the companies, instead, empower the finance department to perform this task. The budget process represents one of few opportunities for the different business functions to work together in order to reflect the corporate strategy and position. Centralizing the budgeting process in the hands of the finance function will produce instead a less accurate reflection of the business.

- No link between strategy and budget process

Traditional budgeting process focuses on cost reduction rather than business value creation, which means strategic initiatives are unjustly lower priorities. When budgets are not aligned with business drivers, the process may be perceived as a futile exercise.

New budget approaches

The final aim and target of the new methods of budgeting are to simplify and optimize the existing process improving precision, reducing time-consuming tasks and avoiding bottlenecks that may occur in the performance management & control offices. Unlike the traditional approaches, the beyond budget allows a real-time valuation and company perspective overview being characterized by a flexible timeframe without time constraints, actual auto-update (daily/monthly) and targeted planning. Following a lean and scalable principle, the process could be described in five main stages as shown in the image below.

1. Load Actual

The data are loaded from accounting with the possibility to schedule an upload on a daily or monthly basis. The actual value loaded will overwrite a potential pre-existed planned value on the live version in order to have a punctual overview of the past performance. However, given the possibility of storing past versions, it is still possible to compare past effective performance with forecast corresponding to the same period (Act vs Frc).

2. Setting

This phase defines ad hoc parameters and assumptions used to set the first planning version (i.e. revenues calculated as a moving average based on past “X” months or seasons). In addition, the process could require the setting of drivers for the allocation of values planned on a higher level of detail suitably designed to allow a faster process. The planning horizon is driven only by the definition of the planning period producing Pre-Closing, Annual/Multi-Year Plan and Medium-Long Term Plans with the same effort and process.

3. Startup

The first version of the plan is modeled computing information available at the last closed month together with parameters identified in the previous phase. The model is able to replicate the same process for each period thus offering from the beginning a starting Live Forecast/Budget version.

4. Plan

The model as a whole is based on the incremental approach. Unlike the more traditional planning processes, the values planned are defined only as the difference from the previous version and could be modified directly by the interested parties (i.e. area managers for the commercial planning). In this way, the efficiency is increased by dividing the total effort involving several corporate responsibility centers, multi-user and following a multi-function approach (development of internal synergies between different functions).

5. Reporting

The model allows a real-time analysis of the deltas between the live version and past forecast, budget, version or scenarios in order always ensure a complete overview through comparison.

Cross-functional approach

The Planning Process is featured by a close relationship between the company's functions and responsibilities centers. Indeed, the introduced methodology is a logical way to reach a perspective of Profit & Loss, Balance Sheet, and Cash-Flow Scheme, guaranteeing the respect of the real streams that characterize the Planning Process. Here below, a graphical representation of a typical cross-functional planning process, which starts from the sales and production plan, passing through a series of independent and scalable modules such as OPEX Plan, CAPEX, HR and Working Capital model.

The system's granularity shows a relevant advantage, such as adaptability and versatility related to company environment (i.e. one company could give more importance to a module rather than another one or could decide to make some changes to the standard approach).