- What would happen if the borders in India were closed for other 6 months? What if they opened before summer?

- How can we prepare for any significant changes in the Euro-Yen exchange rates?

- What is the impact of a two-month delay in customer payments on the financial position?

- Should we delay a planned strategic investment? Alternatively, will we still have enough liquidity?

- Is it better to transfer part of our credit or to start a new medium or long-term loan?

- How would my cash-out plan to suppliers change if I decided to lower the minimum stock levels?

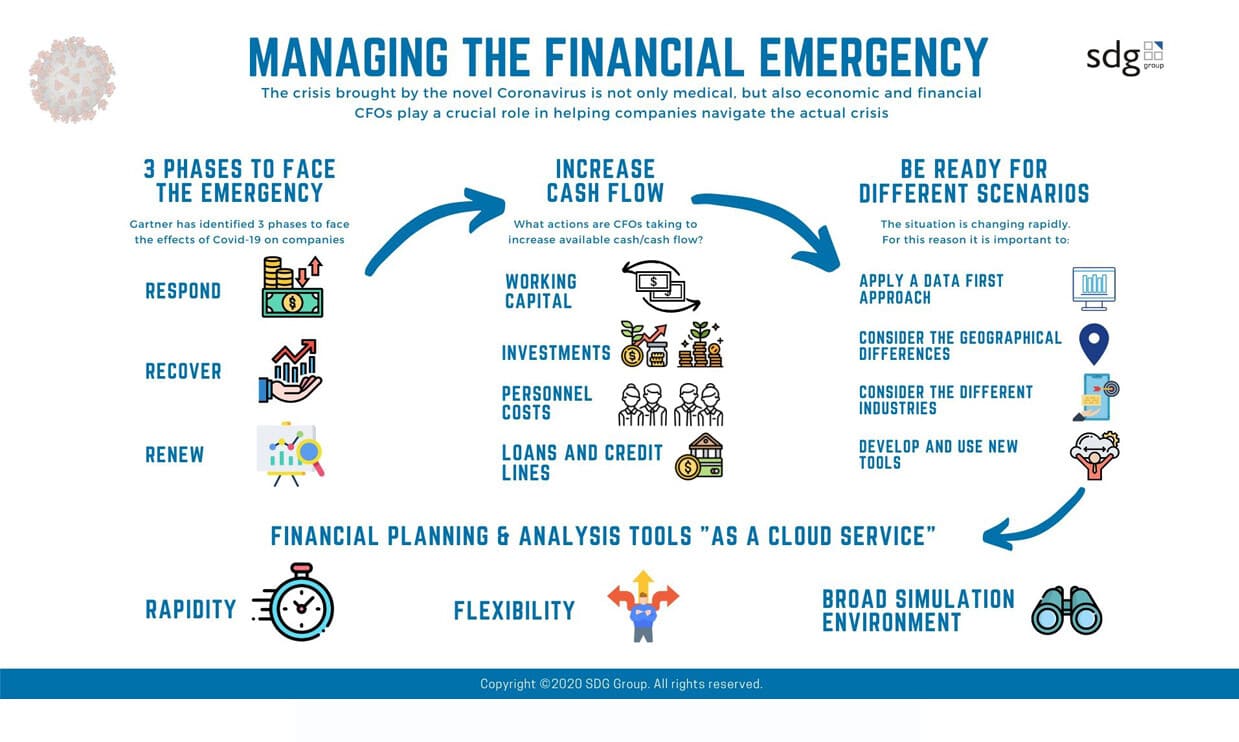

These are just some of the many questions the Chief Financial Officers, CFOs, must quickly find an answer to face the current crisis within companies. The emergency brought by the novel Coronavirus is not only medical, but also economic and financial. The forced stop to a large part of production, the closure of borders, businesses, shops and schools, the lockdown and social distancing have and will have repercussions in the management of companies.

For this reason, companies have started extraordinary measures to deal with the emergency, not only by introducing new ways of working but also by implementing a series of actions to protect employees, customers, suppliers and financial results. In this scenario, CFOs play a strategic and crucial role and must activate several tools to face the crisis in the present and, at the same time, to plan the next phases: the recovery and the achievement of a "new normality".

Thus, which are the tools available for CFOs during the Covid-19 era?

The crisis brought by the Covid-19 pandemic has different logics and dynamics than the 2009 one: the availability of bank credit is not in risk and the financial system does not present structural problems, it is a stable force within the world economy.

CFOs today have more options available than in the recent past. However, this factor also increases the complexity and difficulty of their choices: a "simple" evolved spreadsheet today may not be enough. We need new tools "as a service", flexible and immediate, capable of creating a broader simulation environment, supported by data science, adapting to different scenarios and comparing them quickly.

We collected some elements and strategies to adopt to face the present and plan the future.

Cash flow: new solutions for companies?

The immediate financial impact for companies concerns liquidity: with production stopped, difficulties in distribution, closures of commercial activities, delays in payments, the drop in turnover and investments, the cash flow of companies in the first quarter 2020 was certainly lower than expected.

It is essential to build financial stability for one’s own organization, optimizing liquidity and studying tools and strategies to preserve or increase the cash flow, also according to the peculiarities of the reference sector.

For the CFOs, in the current situation, trusting their feelings could be very risky: they need to find tools that allow them to compare forecasts, to make the right decision quickly.

The levers, on this front, are multiple and may have greater relevance in certain scenarios, less in others.

- Working Capital: The CFO must be able to simulate different scenarios on the disposal of existing warehouses, on debts and credits, on the ability of customers to support pre-agreed sales rates or to pay as in the past, on the possibility of reducing costs and renegotiate the payment terms with certain suppliers.

These fast simulations, depending on the moment of the crisis, may have to be based on different personal attributes of the customer (channel, market, sector) or of the supplier (supply criticality) with a top-down logic not supported by normal spreadsheets or bi-dimensional tables;

- Investments: the CFO must be able to re-evaluate, on comparable scenarios, the planned investment projects and initiatives. This can be done simulating the portfolio of actionable initiatives and the payment conditions obtainable from suppliers;

- Personnel costs: on the cash flows relating to Personnel, the simulation is focused on the potential use of special tools made available by the institutions, on the temporary reduction of the headcount, on the decrease or extension of bonuses and incentives.

- Loans and credit lines: finally, the CFO must be able to act on financial coverage. He has to hypothesize changes to existing positions and agreements with the various financial institutions. Then the CFO has to plan the potential additional measures (such as assignment of credit, modification of credit lines and the opening of new medium or long-term mortgages).

Everything must be done keeping under control the impact on profitability through the real-time calculation of financial charges.

It is necessary to dialogue with all the players involved and act with balance and attention, taking into account the possible scenarios that could arise at the end of the next quarter.

In this case, an advanced simulation engine can make a difference.

Financial planning & analysis tools "as a cloud service"

On one hand, companies have to deal with the needs of the present. However, on the other hand, it is essential for them to imagine future scenarios, increase efficiency and optimize production in the recovery phase, considering all the risk factors that characterize the specific industries: from production to distribution, from evolution of demand to changes in government restrictions and decrees, up to liquidity problems.

In such a rapidly evolving situation as the current one, a data first approach is fundamental. It will allow making informed decisions taking into account all the many variables.

In the event of a financial crisis such as that of 2009, in fact, some measures may be applicable across multiple sectors and a 6 months plan will unlikely change.

On the contrary, in the current emergency scenario, the impact on markets, channels, sectors is unpredictable even in the short term. In this case, the classic spreadsheet or a non-modern planning tool (often the platforms available to CFOs for projections and simulations) may not be enough to consider all the scenarios and variables of such a complex, various and rapid reality.

Finally, the variables linked to the different impact of Covid-19 in relation to the various territorial areas must also be considered: an element that could be crucial in some sectors such as the supply chain.

Speed is fundamental: to obtain a realistic projection of cash flows it is necessary to involve all the stakeholders, inside and outside the company, and to be able to simulate alternative scenarios based on information of different nature, from logistics to sales, from suppliers to the treasury. We need technological solutions able to guarantee what-if simulations and sensitivity analyses on the levers, which influence the financial position.

This is why SDG is working on financial planning and analysis tools "as a service", to develop personalized financial forecasts capable of adapting to different scenarios, activating well-defined strategic levers, which can offer CFOs the elements to guide the choices of companies for the next few months.

Respond, Recover and Renew: three phases to face the crisis

Gartner identified three phases to face the emergency created by Covid-19 within companies: Respond, Recover and Renew.

We are now in the initial phase where, as mentioned, a series of measures will be necessary to face the crisis in the short term, in particular by managing liquidity problems within companies. Speed and flexible tools are required to offer answers and guide choices with minimal effort.

The second phase is called “Recover”: in this phase, it will be essential to restore the financial plans and optimize the production and available resources, waiting for a "new normality". This is the third and final phase, in which companies will have to adapt to new market logics and needs.

Once out of this situation, with different times and dynamics according to the sectors, it will be necessary to review and improve one’s own business model, identify new tools, communicate constantly with investors: the crisis, thanks to this approach, could reveal itself as an opportunity to renew sectors and review their strategies in view of a "new normality".

Finally, companies need to imagine, for the near future, new work environments, new ways of relating that take into account social distancing, new habits and needs of consumers. These elements will also have to be considered in financial planning and could lead to additional cuts or new costs.

To predict and manage all this complexity, as mentioned, human forecasting skills might not be sufficient. The good news is that these skills can be "increased".

At SDG Group we help our customers to obtain increasingly decisive decision support, through data science techniques and "analytics" enabled by artificial intelligence.

This is the only way for us to be truly ready in the future and no longer alone in face of unpredictable events.

.png?width=2000&name=SDG%20-%20Logo%20White%20(1).png)