A lean financial planning process is one step in the right direction.

Enterprises that approach lean management often experience financial control as a restriction. The bias: traditional budgeting and cost reporting is a system based on rigid frames, and it burdens an agile and innovative enterprise with unnecessary and counterproductive overhead and friction. Thus, apparently lean and financial planning seem to be contradictory terms.

But is it true?

So, what does ‘Lean’ mean? The core idea of lean management is to maximize customer value while minimizing waste. It is lean to generate a fix or even higher value for customers with fewer resources. But is this just another expression for headcount reduction and budget cuts? Way off the mark. In fact, ‘Lean Planning’ means in our case to downsize the process of financial planning itself. It does not mean to take less time to think about the plan, but to save time in the manual handling of putting the figures together.

An optimization of the planning process itself strengthens a better output and performance for the enterprise. In doing so, lean planning makes clients more satisfied, because lowering business costs and improving profitability by controlling department means reducing or eliminating the unnecessary. A lean financial planning process is one step in the right direction.

Let’s look at a Business Case. We’ll see a financial department subsidiary in Europe, with regional units in over 30 countries with around 100 budget owners. Their goal is to become a better business partner for a worldwide acting holding by realizing a lean planning system. But how do they manage this? We will answer this question in the following sections.

What was their pain?

To be frank, their pain was a rigid spreadsheet set which they used to manage their planning issues. In the course of time, the spreadsheets grew far too big to work on and a revision control was almost impossible. It was barely feasible to perform a top-down plan. In addition, an overall view got lost, because the spreadsheets had more than 50 tabs per country.

To achieve an accurate deadline in the planning process many co-workers were busy for days to merge the different spreadsheets. After this long merging process, it was impossible to make even small changes in budget figures without repeating the whole process.

So, what did they change?

With the support of SDG Group’s experts, they re-engineered the financial planning process and implemented a planning software to transform their planning process into a lean planning system including an automated workflow. The payoff? They computerized most of the planning process and minimized the effort.

For example, all data sources are now loaded automatically into the database. The central controlling department does not have to collect CSV-Files from the country units anymore. The budget owners of the country units are now able to upload for example their HR Plan into the planning software in consideration of security settings.

Profit and cost center planning is now done in the planning software on multi-dimensional planning screens. Users can enter their budget figures in detail like they did in their earlier used spreadsheets.

The multi-dimensional approach allows them to decide for themselves from which perspective they want to enter the figures. For example, if they want to plan the cost center itself and let the algorithm spread the figures on internal orders based on historical distributions. If preferred, the user can also plan all internal orders himself in detail.

An automated workflow assures at every stage during the planning process that it is possible to see which users have already finished their planning steps and thereby the progress of this process. Regional and central controlling can check budget figures and approve or reject them. If controlling rejects the figures, the responsible user recognizes this in the planning software and he can update his profit or cost center budget.

The software also allows the user to enter budget figures on a high level and spreads it automatically on detailed dimensions. This enables general management or controlling department to make some general adjustments and, for example, enter a 3 percent budget cut or an increase in profits of 7 percent while the software spreads it over all regional units and all profit and cost center. It is even possible to exclude some of the units from this spreading algorithm.

After all, users have finished their planning and controlling department have made their adjustments, the software calculates a resulting profit & loss statement.

Furthermore, they gained an overall view with one click to a performance dashboard, and by drilling-down, they are getting in seconds a much more detailed planning grade. Also, all different countries of the subsidiary are generating their balance plan in a few steps from the profit & loss statement.

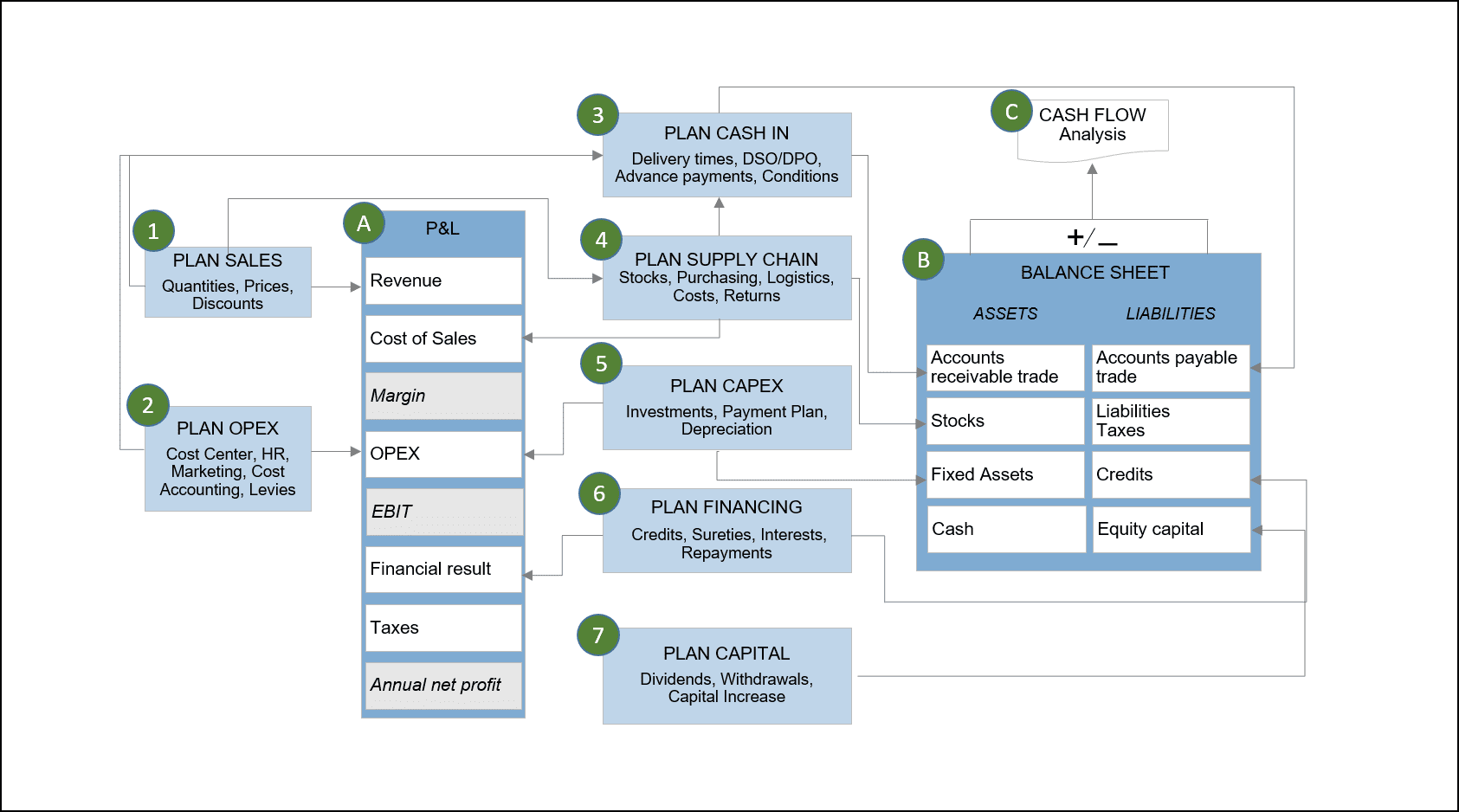

Integrated Planning

And the advantage?

Overall, the financial planning process became much leaner. The controlling department eliminated the unnecessary from the planning process. Manual steps have been reduced and integration of the different plans by country to one budget plan for the whole subsidiary has been automated. By workflows, they have at any time an overall view on the state of planning, and they are consistently able to monitor any impact on the P&L and balance plan.

They can perform a rolling forecast very quickly and without big effort. An important advantage here is that now they are able to adjust the plan and simulate the impact of changed conditions on the P&L and balance plan. With the help of this knowledge, they can react fast and make smart business decisions.

Now then, they are working much faster, focusing on their job: lowering business costs and improving profitability, not at least by avoiding a deficient planning.

They are even considering to develop an additional module with a detailed sales planning. Based on this sales plan the module should calculate the changes in stock for different warehouses across Europe.

What is the conclusion?

All in all, we have seen that ‘Lean Planning’ does not mean to plan less, but to reduce the unnecessary effort during the planning process.

With the help of modern planning software, it is possible to rethink this process and automate many manual and time-consuming tasks. Enterprises should take the chances which planning software provides them and use them to lower business costs and create a higher profitability.

.png?width=2000&name=SDG%20-%20Logo%20White%20(1).png)